PCI DSS

Data breaches inflicted a significant financial toll in 2022, averaging $4.35 million in costs. These figures underscore the urgent need for robust data security measures, particularly within organizations handling payment card information.

The Payment Card Industry Data Security Standard (PCI DSS) is a pivotal framework for fortifying data security, especially concerning payment cards. It comprises a set of well-recognized policies and procedures geared toward enhancing the security of credit, debit, and cash card transactions while safeguarding cardholders’ personal information.

Under the governance of the Payment Card Industry Security Standards Council (PCI SSC), which is a consortium comprising major credit card companies, PCI DSS has a central goal of reducing the risk of cybersecurity breaches concerning sensitive data and mitigating the potential for fraud within organizations that handle payment card information. This collection of standards holds vital importance for various entities, including service providers and merchants, involved in card data processing, storage, or transmission.

Why Choose Accorian For Your PCI DSS Compliance?

Accorian holds the prestigious distinction of having a team of highly Qualified PCI QSAs (Qualified Security Assessors) specializing in assessing PCI compliance, particularly emphasizing network infrastructure. We are also CREST accredited and an ASV (Approved Scan Vendor). Our PCI accreditations underline our expertise and credibility in cybersecurity and PCI DSS compliance.

Our potential client industry includes sectors such as banking, financial services, credit unions, eCommerce, and SaaS that must adhere to payment card industry DSS requirements.

Accorian is PCI QSA

Our certified QSAs play a pivotal role in safeguarding cardholder data. They conduct on-site and remote assessments of security controls, offering valuable insights and recommendations for improvement. They also support developing and implementing essential security policies and procedures.

Accorian is PCI ASV

As ASV, we conduct comprehensive vulnerability assessments and penetration testing, helping organizations fortify their security measures. We meticulously define the scope of PCI compliance by evaluating critical components like firewalls, routers, and switches. This assessment also identifies programs, subnets, and network segments for handling cardholder data.

PCI DSS Transition

from v3.2 to v4.0

In March 2022, the Payment Card Industry Security Standards Council unveiled the latest iteration of PCI DSS, marking a significant transition from v3.2 to v4.0. This update provides a more defined vision of the future payment security landscape.

Four Key Motivations to Drive the Revision:

Our Methodology

Scoping Assessment

Determine the applicable scope, with or without the inheritance of controls and card flow

Readiness/Gap Assessment

Assist in understanding your current readiness concerning PCI DSS compliance

vSecurity Team Support

Streamline PCI DSS requirements by providing remediation guidance, aiding in evidence collection, providing program management, and augmenting your team to assist in remediation efforts

Policy & Procedure Development

Assist in developing or updating your security framework and policies

Pre- Audit

Conduct a readiness audit to ascertain that you meet the PCI requirements

Assisted SAQ Filling

Help complete and submit your Self-Assessment Questionnaire (SAQ)

PCI Audit & RoC

Perform a final audit with reporting conducted by our Qualified Security Assessor (QSA)

PCI ASV Scanning

Conduct the mandatory quarterly PCI Approved Scanning Vendor (ASV) network scans

Applicability of PCI DSS

PCI standards have a broader impact on the payment card industry, encompassing all companies that handle credit card transactions and have access to cardholder data (CHD) or sensitive authentication data (SAD). This standard also extends to service provider companies involved in credit card processing, whether directly or indirectly, due to the influence of their Third-Party Risk Management Strategy.

As a result, payment card industry compliance is a benchmarking security standard for various organizations, irrespective of their size, transaction volume, or how they collect information (directly or indirectly).

- Directly accept credit card/account information

- Indirectly accept credit card/account information

- Service Providers/Vendors to companies who directly/indirectly take credit card/account information

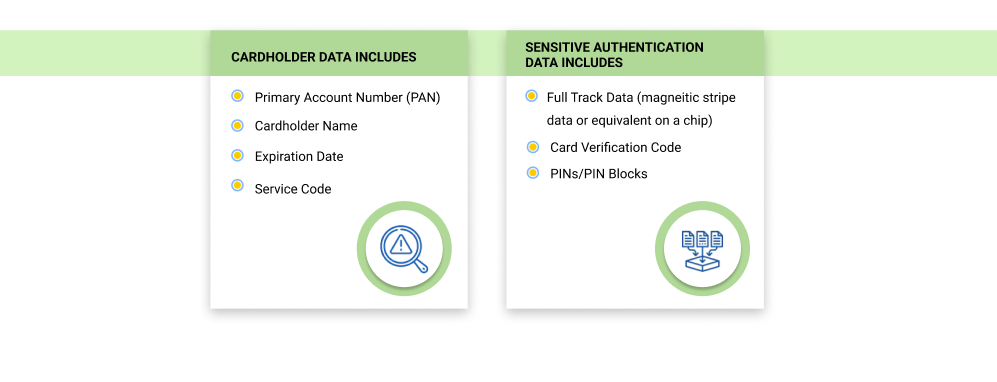

What Data Does

PCI DSS Impact?

CARDHOLDER DATA INCLUDES

- Primary Account Number (PAN)

- Cardholder Name

- Expiration Date

- Service Code

SENSITIVE AUTHENTICATION DATA INCLUDES

- Full Track Data (magneitic stripe data or equivalent on a chip)

- Card Verification Code

- PINs/PIN Blocks

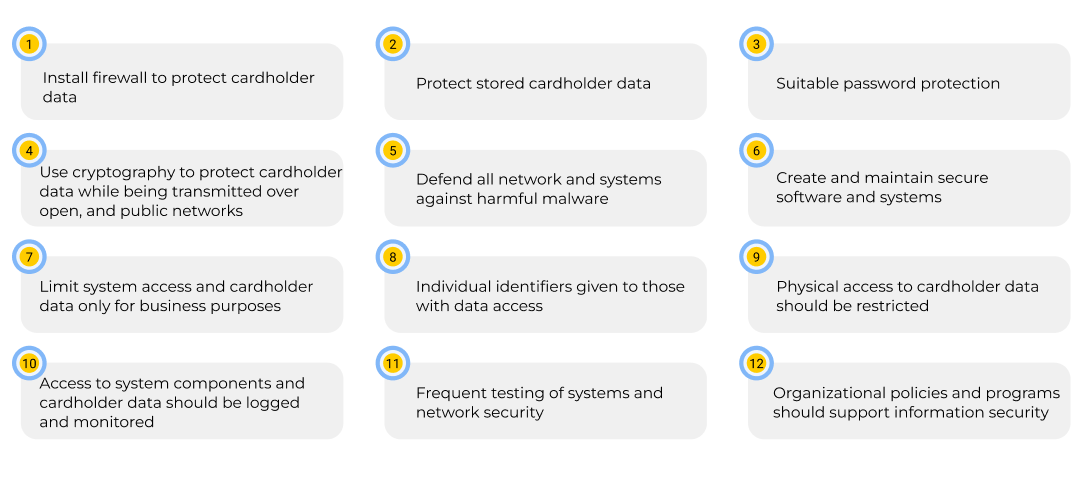

12 PCI DSS Requirements

PCI DSS companies must adhere to 12 fundamental PCI DSS compliance requirements to handle credit card data securely. Non-compliance of which elevates the risk of data breaches and fraud.

Install a firewall to protect cardholder data

Protect stored cardholder data

- Install a firewall to protect cardholder data

- Protect stored cardholder data

- Suitable password protection

- Use cryptography to protect cardholder data while being transmitted over open, and public networks

- Defend all networks and systems against harmful malware

- Create and maintain secure software and systems

- Limit system access and cardholder data only for business purposes

- Individual identifiers given to those with data access

- Physical access to cardholder data should be restricted

- Access to system components and cardholder data should be logged and monitored

- Frequent testing of systems and network security

- Organizational policies and programs should support information security

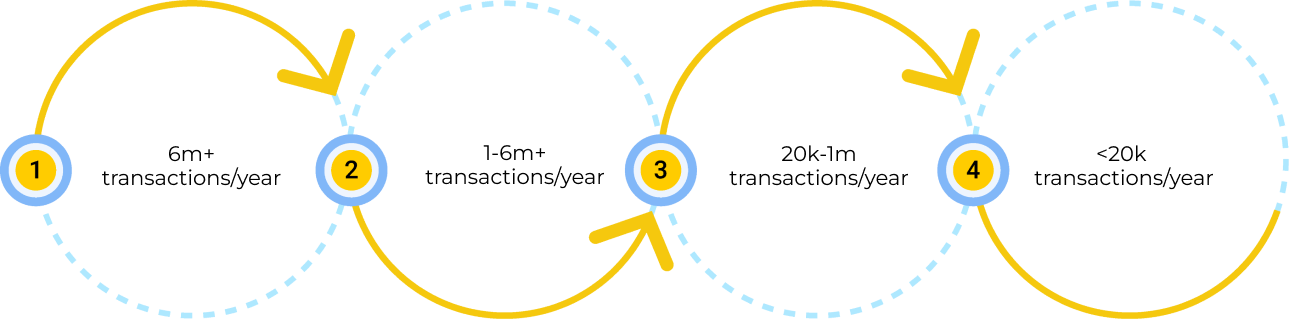

PCI DSS Merchant Level Classification

The PCI DSS categorizes companies into four merchant levels based on the volume of transactions they process yearly.

The 4 Levels of PCI Compliance

MERCHANT LEVEL 1

Level 1 merchants are subject to audits by PCI QSAs (Qualified Security Assessors). This audit has more stringent requirements than other levels, creating a PCI RoC (Report on Compliance). This report uncovers findings by reviewing the organization’s security policies, procedures, and controls to protect cardholder and account data. The audit also encompasses an on-site assessment and an evaluation of any compensatory controls.

The audit takes place annually or when there’s a change in the environment. Complying with PCI Level 1 and RoC requirements demands meeting a high number of criteria, substantial implementation efforts, significant time costs, and a rigorous approach. Once RoC is obtained through assessment by a PCI QSA, the company is eligible to display the PCI Compliant logo.

MERCHANT LEVEL 2, 3, 4

Companies must submit their SAQs (Self-Assessment Questionnaires) for all three merchant levels. There are 9 types of SAQs, each with varying requirements, ranging from 24 to 370.

Furthermore, non-level 1 merchants may be required to undergo a PCI RoC audit in certain instances due to their crucial role in the supply chain. This is decided by the acquirer or, sometimes, requested by end clients.

Choosing The Right PCI DSS SAQ

Choosing the right SAQ (Self-Assessment Questionnaire) ensures that your organization complies with the relevant PCI DSS requirements.

PCI DSS

SAQ TYPE

Eligibility Criteria

No. of Questions

SAQ A

For e-commerce/mail/telephone-order (card-not-present) merchants who have completely outsourced all cardholder data functions. The merchant must not have electronic storage, processing, or transmission of any cardholder data on his systems or premises.

24

PCI DSS SAQ TYPE – SAQ A

Eligibility Criteria

For e-commerce/mail/telephone-order (card-not-present) merchants who have completely outsourced all cardholder data functions. The merchant must not have electronic storage, processing, or transmission of any cardholder data on his systems or premises.

No. of Questions – 24

SAQ A-EP

For e-commerce-only merchants that rely on third-party service providers to handle card information and have a website that doesn’t process credit card data but could impact the security of the payment transaction. The merchant must not have electronic storage, processing, or transmission of any cardholder data on his systems or premises.

192

PCI DSS SAQ TYPE – SAQ A-EP

Eligibility Criteria

For e-commerce-only merchants that rely on third-party service providers to handle card information and have a website that doesn’t process credit card data but could impact the security of the payment transaction. The merchant must not have electronic storage, processing, or transmission of any cardholder data on his systems or premises.

No. of Questions – 192

SAQ B

For merchants who utilize imprint machines and/or standalone dial-out terminals and do not transmit, process, or store electronic cardholder data. This does not apply to e-commerce activities.

41

PCI DSS SAQ TYPE – SAQ B

Eligibility Criteria

For merchants who utilize imprint machines and/or standalone dial-out terminals and do not transmit, process, or store electronic cardholder data. This does not apply to e-commerce activities.

No. of Questions – 41

SAQ B-IP

For merchants using only standalone, PTS-approved payment terminals with an IP connection to the payment processor and who do not store electronic cardholder data. This does not apply to e-commerce activities.

87

PCI DSS SAQ TYPE – SAQ B-IP

Eligibility Criteria

For merchants using only standalone, PTS-approved payment terminals with an IP connection to the payment processor and who do not store electronic cardholder data. This does not apply to e-commerce activities.

No. of Questions – 87

SAQ C-VT

For merchants who utilize a virtual terminal on one computer dedicated solely to card processing and who do not store electronic cardholder data. This does not apply to e-commerce activities.

161

PCI DSS SAQ TYPE – SAQ C-VT

Eligibility Criteria

For merchants who utilize a virtual terminal on one computer dedicated solely to card processing and who do not store electronic cardholder data. This does not apply to e-commerce activities.

No. of Questions – 161

SAQ C

For any merchant who utilizes a payment application connected to the internet without electronic cardholder data storage.

84

PCI DSS SAQ TYPE – SAQ C

Eligibility Criteria

For any merchant who utilizes a payment application connected to the internet without electronic cardholder data storage.

No. of Questions – 84

SAQ P2PE

For merchants who utilize approved point-to-point encryption (P2PE) devices with no electronic cardholder data storage.

34

PCI DSS SAQ TYPE – SAQ P2PE

Eligibility Criteria

For merchants who utilize approved point-to-point encryption (P2PE) devices with no electronic cardholder data storage.

No. of Questions – 34

SAQ D for Merchants

For all SAQ-eligible merchants who don’t meet the criteria for other types. For merchants who do not outsource their credit card processing or use a P2PE solution, they may store credit card data electronically.

328

PCI DSS SAQ TYPE – SAQ D for Merchants

Eligibility Criteria

For all SAQ-eligible merchants who don’t meet the criteria for other types. For merchants who do not outsource their credit card processing or use a P2PE solution, they may store credit card data electronically.

No. of Questions – 328

SAQ D for Service Providers

For service providers deemed eligible to complete an SAQ

370

PCI DSS SAQ TYPE – SAQ D for Service Providers

Eligibility Criteria

For service providers deemed eligible to complete an SAQ

No. of Questions – 370

For level 2-4 merchants, it’s crucial to complete the SAQ by providing answers to all questions, indicating compliance, or stating specific requirements as “not applicable.” Even if a single question is left unanswered, the merchant will be considered non-compliant and must promptly address and mitigate the associated risks.

Each SAQ includes an expected testing column that offers guidance to merchants, describing the testing activities necessary to demonstrate PCI DSS compliance.

After finishing the SAQ, an Attestation of Compliance (AoC) is required, which must be completed by the merchants and signed by

the company’s CISO or officer.

Resources:

CONSULTING & ASSESSMENT SERVICES

Office Address

Accorian Head Office

6,Alvin Ct, East Brunswick, NJ 08816 USA

Accorian Canada

Toronto

Accorian India

Ground Floor,11, Brigade Terraces, Cambridge Rd, Halasuru, Udani Layout, Bengaluru, Karnataka 560008, India

Ready to Start?

Wordpress Developer (3-5 Years)

Senior Manager - Penetration Testing (5-7 years)

Senior Manager - Compliance (5-7 Years)

Security Team Lead / Sr. Security Consultant (3-5 Years)

Security Consultant (1-3 Years)

Project Manager (2 - 4 Years)

Penetration Tester Consultant (2-4 years)

Lead Software Architect (10 years as a software developer, 3 years as a technical architect)

IT Analyst (1-2 Years)

Developer (3-5 Years)

Content Strategist & Editor (2-4 Years)

Role Summary:

As a wordpress developer, you would be responsible for the development, maintenance, and optimization of our company’s website. This role requires a strong understanding of web development technologies, content management systems, and a keen eye for design and user experience. You will play a crucial role in enhancing our online presence and ensuring a seamless user experience for our audience.

Mandatory Skill Sets/Expertise:

- Strong knowledge of web design principles and user experience best practices.

- Proficiency in web development languages (e.g., HTML, PHP, CSS, JavaScript)

- Proficiency in content management systems (e.g., WordPress, Drupal).

- Experience in managing Security tools – AV, MDM & DLP

Key Attributes:

- Proven experience in web development and content management.

- Familiarity with SEO strategies and tools.

- Excellent problem-solving skills and attention to detail.

- Strong communication and collaboration abilities.

- Ability to adapt to evolving web technologies and industry trends.

Key Responsibilities:

- Website development – Plan and execute website development projects. Develop and implement new website features, pages, and functionalities. Optimize user experience, including site navigation, page loading speed, and overall usability.

- In-depth expertise in WordPress – Demonstrate expertise in developing and customizing WordPress themes, plugins, and templates. The candidates should be proficient in PHP, HTML, CSS, and JavaScript, and have hands-on experience with popular WordPress frameworks and libraries.

- Multisite Management – Strong experience in efficiently managing WordPress multisite networks, including setup, configuration, maintenance, ensuring their stability and optimal performance. Implement A/B testing and gather user feedback to make data-driven improvements.

- Security and Maintenance – Ensure the security and integrity of WordPress installations by implementing best practices and staying updated with the latest security trends. Perform regular maintenance tasks to keep websites up-to-date and running smoothly.

- Server Management – Having hands-on experience in managing the Codes. Regularly update and maintain website content, including text, images, and multimedia elements

A day in the life

- Perform Penetration Testing for networks (internal & external), applications, APIs & cloud assets

along with Red & Purple Team assessments - Vulnerability identification and analysis

- Collaborate with team members and stakeholders to define project scopes, review test results,

and determine remediation steps - Draft reports and communicate complex security concepts and test findings to clients and

stakeholders - Make expert recommendations to help clients improve their information security program

- Work on researching & developing utilities, toolkits, processes, tactics, and techniques

Qualifications & Requirements

- 5-7 years of penetration testing experience, preferably in highly regulated industries and for

global clients - At least 2-3 years of experience in managing a team is a plus

- Proficiency with scripting and programming languages

- Advanced problem-solving skills

- OSCP/OSWE certification preferred but, GPEN, GWAPT, GXPN, CREST, CESG, and similar

certifications are a plus - Experience with Cobalt Strike a plus

- Strong written and verbal communication skills

- Ability to work autonomously with little directional oversight

- Ability to lead a project and multiple testers

- Commitment to quality and on-schedule delivery; and a proven ability to establish and meet

milestones and deadlines - Customer-focused mentality to understand and appropriately respond to customers’ business

needs

Role Summary

The senior manager is responsible for leading and sustaining the team that drives the compliance strategy by working collaboratively with internal teams, SMEs, external customers, vendors, auditors and other stakeholders. He/she should be able to work collaboratively with other departments and stakeholders to achieve company-wide goals and satisfy the client.

Mandatory Skill Sets/Expertise

- Relevant bachelor’s or master’s degree in computer science/ IT Auditing/ Information Systems/ Privacy.

- Have at least 5-7 years of relevant information security auditing experience and advanced knowledge of general controls (security, change management, disaster backup recovery, data centre, infrastructure, etc.), IT governance processes (ITIL).

- Ability to critically review security policies and procedures, design and implementation of security policies, procedures, standards and controls in line with regulation and/or current standards.

- Good understanding and implementation expertise of industry standards in cybersecurity (ISO, ITIL, NIST, ISF, SOC, HITRUST, PCI DSS, HIPAA) and privacy (GDPR, ISO 27018) is an advantage.

- Good project management skills with the ability to collaborate with teams across multiple locations and a strong command of the English language.

- Relevant industry recognized certifications such as CISSP/CISA/CISM.

Key Attributes

- Leadership: To lead by example, collaborate with the team, and make appropriate decisions when required. effectively communicate the vision and goals of the Accorian.

- Mentoring: To mentor individuals from graduate to industry qualified, with the aim of motivating and enhancing their personal and professional development.

- Communication: To communicate effectively both verbally and in writing, with the team and clients, sharing information in a clear and concise manner.

- Problem-solving: Strong analytical skills to identify and solve complex problems within the GRC domain.

Key Responsibilities

- Setting strategic direction for audit readiness, managing compliance programs, driving continuous improvement activities, & reporting metrics.

- Interfacing with stakeholders, articulating control implementation and impact, and establishing considerations for applying security and compliance concepts to a technical cloud environment.

- Effectively communicating compliance program results, including assessment status, workflow, remediation, and reporting, to a broad audience including peers, senior and executive leaders.

- Leading small teams by assigning and tracking individual tasks and ensuring the team meets milestones and addresses challenges.

- Coordinating the overarching annual audit plan with internal and external auditors to support delivery of multiple, simultaneous audits and certifications.

- Supporting delivery of audit milestones to ensure audit timelines stay on target by proactively identifying and coordination resolution of roadblocks.

- Collaborating cross-functionally with technology and business stakeholders to drive, track, and resolve all aspects of compliance readiness and audit execution

Role Summary:

The Sr. Security Consultant / Team Leader is responsible for leading a team of Security Consultants, managing team and professional development goals, ensuring on-time delivery of GRC projects, and providing expert guidance to team members on GRC-related matters.

Mandatory Skill Sets/Expertise

- Relevant bachelor’s or master’s degree in computer science/ IT Auditing/ Information Systems/ Privacy.

- Have a minimum of 3-5 years of experience in the domain of cybersecurity and privacy.

- Experience in information security standards and best practices (ISO 27001, SOC 2, NIST, HIPAA, PCI DSS, HITRUST, etc).

- Experience in performing assessments and audits.

- Deep understanding of risk management principles and IT controls.

- Certified in relevant and industry recognized certifications.

Key Attributes:

- Leadership: To lead by example, collaborate with the team, and make appropriate decisions when required. effectively communicate the vision and goals of the Accorian.

- Mentoring: To mentor individuals from graduate to industry qualified, with the aim of motivating and enhancing their personal and professional development.

- Communication: To communicate effectively both verbally and in writing, with the team and clients, sharing information in a clear and concise manner.

- Problem-solving: Strong analytical skills to identify and solve complex problems within the GRC domain.

Key Responsibilities:

- Assessing cybersecurity risks and vulnerabilities and partnering with the security team to identify and analyze potential threats, evaluating their impact and likelihood of occurrence.

- Developing and implementing GRC strategies to analyze industry regulations and standards relevant to cybersecurity, translating them into practical policies and procedures for our organization.

- End to End Implementation of various standards, regulatory and compliance requirements such as SOC 2, HIPAA, HITRUST, NIST CSF, ISO 27001.

- Conducting GRC audits and collaborating and performing regular evaluations of our security controls and compliance measures, identifying gaps, and recommending improvements.

- Collaborating with strategic-integration and fostering strong relationships across various departments (IT, security, legal, compliance) to ensure seamless integration of GRC processes and cybersecurity initiatives.

- Provide expert advice on GRC strategies, frameworks, and methodologies to clients.

- Collaborate with internal and external auditors, providing necessary documentation and support for audits.

- Ensure clients’ adherence to relevant regulations, standards, and industry-specific compliance requirements.

- Developing and delivering training programs to educate employees on cybersecurity best practices and compliance requirements, promoting a culture of security awareness.

- Staying informed on emerging threats and regulations and continuously update your knowledge on the evolving cybersecurity landscape and adapt your strategies accordingly.

- Coordinating the overarching annual audit plan with internal and external auditors to support delivery of multiple, simultaneous audits and certifications.

- Supporting delivery of audit milestones to ensure audit timelines stay on target by proactively identifying and coordination resolution of roadblocks

Role Summary

Accorian is actively seeking for a dynamic and seasoned Consultant/Senior Consultant specializing in

the Governance, Risk, and Compliance (GRC) domain to join our team. The preferred candidate will

assume a pivotal role in providing strategic guidance to clients regarding the implementation of sound

risk management practices overseeing vendor relationships, conducting audits across various

frameworks, and harnessing the capabilities of the GRC tool. This multifaceted position necessitates a

profound comprehension of GRC principles, regulatory compliance, and the ability to implement

resilient risk management strategies. Collaborate extensively with cross-functional teams, conduct

evaluations of organizational processes, and deliver strategic recommendations aimed at enhancing

GRC frameworks.

Mandatory Skill Sets/Expertise

1. Bachelor’s or master’s degree in computer science, Information Security, Risk Management,

Cyberlaw, or a related field.

2. Proficient in leading GRC frameworks and methodologies (SOC, ISO 27001, HIPPA, NIST, PCI DSS,

etc.).

3. Strong understanding of cybersecurity frameworks and principles (e.g., NIST Cybersecurity

Framework, ISO 27001, HIPAA).

4. Familiarity with audit processes, internal controls, and assurance methodologies.

5. Experience with GRC software solutions (e.g. SAP GRC, ACL, Archer, etc.).

6. Knowledge of risk assessment, control design, and reporting methodologies

7. Ability to work independently and as part of a team.

Preferred Certifications: CISSP, ISO 27001 Lead Auditor or Implementer.

Key Attributes:

a. 1 – 3 years of experience in consulting or industry roles related to GRC.

b. Proven track record of successful GRC program implementation and optimization.

c. Customer-centric mindset with a focus on understanding and addressing clients’ unique needs.

d. Ability to translate complex technical concepts into clear and actionable insights for clients.

e. Passion for staying up to date on the latest trends and developments in GRC.

f. Strong work ethic and a commitment to delivering high-quality results.

g. Add on Strong project management skills to successfully lead and execute projects.

Key Responsibilities:

1. Assessing cybersecurity risks and vulnerabilities and partnering with the security team to identify

and analyze potential threats, evaluating their impact and likelihood of occurrence.

2. Developing and implementing GRC strategies to analyze industry regulations and standards

relevant to cybersecurity, translating them into practical policies and procedures for our

organization.

3. Conducting GRC audits and collaborating and performing regular evaluations of our security

controls and compliance measures, identifying gaps, and recommending improvements.

4. Collaborating with strategic-integration and fostering strong relationships across various

departments (IT, security, legal, compliance) to ensure seamless integration of GRC processes and

cybersecurity initiatives.

5. Provide expert advice on GRC strategies, frameworks, and methodologies to clients.

6. Collaborate with internal and external auditors, providing necessary documentation and support

for audits.

7. Ensure clients’ adherence to relevant regulations, standards, and industry-specific compliance

requirements.

8. Developing and delivering training programs to educate employees on cybersecurity best

practices and compliance requirements, promoting a culture of security awareness.

9. Staying informed on emerging threats and regulations and continuously update your knowledge

on the evolving cybersecurity landscape and adapt your strategies accordingly

Role Summary

The role of the Project Manager would be to help plan and track cybersecurity & technology projects to meet KRAs, milestones & deadlines. This would also include coordinating. meetings with clients & internal teams and resource planning. The primary KRA would be to ensure projects are delivered on a timely manner and all stakeholders. are updated about the latest status of the project.

Mandatory Skill Sets/Expertise

- Great communication skills – written & oral

- At least 2 to 4 years of project coordination & management experience for technology consulting or implementation services.

- Strong planning, organizing, and execution skills

- Ability to work collaboratively with global teams & clients, and with staff of different backgrounds and experience levels along with managing goals.

- Strong interest in learning and developing professional skills

- Logical problem-solving skills; looks beyond immediate problems to consider root causes and addresses them.

- Possess a high degree of personal responsibility.

- Must have completed graduation.

Key Attributes

- Excellent communication skills

- Strategic thinking and visioning

- Excellent attention to detail

Key Responsibilities: –

- Provide support and assistance to the program and aid by tracking.

- Completion of all required tasks to meet project and client goals.

- Foresee; manage; and raise appropriate visibility to risks and issues.

- Drive resolution of any conflicts and escalate as needed to avoid roadblocks.

- Drive execution rigor using set practices; Manage & Drive Change wherever needed.

- Generate and publish weekly reports; corporate process improvements in developing new reports.

- Organizing, attending, and participating in stakeholder meetings.

- Documenting and following up on important actions and decisions from meetings.

- Developing project strategies

- Ensuring projects adhere to our clients’ frameworks and all documentation is maintained. appropriately for each project

- Ensure stakeholder views are managed towards the best solution.

- Chair and facilitate meetings where appropriate; distribute minutes to all project team.

- Track deliverables and calendar timelines

A day in the life

- Perform Penetration Testing for networks (internal & external), applications, APIs & cloud assets along with Red & Purple

Team assessments - Vulnerability identification and analysis

- Collaborate with team members and stakeholders to define project scopes, review test results,

and determine remediation steps - Draft reports and communicate complex security concepts and test findings to clients and

stakeholders - Make expert recommendations to help clients improve their information security program

- Work on researching & developing utilities, toolkits, processes, tactics, and techniques

Qualifications & Requirements

- 2-4 years of penetration testing experience, preferably in highly regulated industries and for global clients

- Proficiency with scripting and programming languages

- Advanced problem-solving skills

- OSCP certification preferred but, GPEN, GWAPT, GXPN, CREST, CESG and similar certifications a plus

- Experience with Cobalt Strike a plus

- Strong written and verbal communication skills

- Ability to work autonomously with little directional oversight

- Ability to lead a project and multiple testers

- Commitment to quality and on-schedule delivery; and a proven ability to establish and meet milestones and deadlines

- Customer-focused mentality to understand and appropriately respond to customers’ business needs

Role Summary:

As the Lead Software Architect, you will be a key leader in the development and evolution of our B2B SaaS product & it’s associated systems. The entire development team will report to you.

Drawing upon your extensive technical expertise and industry knowledge, you will design and implement scalable, robust, and efficient software solutions. Collaboration with cross-functional teams, technical leadership, and staying abreast of emerging technologies will be essential for success in this role.

About Our Product:

GORICO was incepted by security practitioners & audits with decades of experience to simplify the security conundrum and streamline the security compliance and security maintenance process. Security is a growth enabler today as it’s table stakes for doing business and a mandatory requirement as part of the third-party risk strategy of clients.

This is a single solution tailored to an organization to manage all your security adherence, compliance, vendor risk, vulnerability management , policy & procedure management and risk assessment needs.

It enables behaviour change and shift in the mindset towards security. It’s the only way to address the current reactive approach to it. Hence, going from a once a year or, couple of times a year audit rush to year long sustenance of security.

Hence, GORICO empowers organizations to understand, attain and sustain true security.

Mandatory Skill Sets/Expertise

- Proven experience as a Software Architect, with a track record of successful project delivery. A minimum of 2-3 years in this role

- Proven experience of building a B2B SaaS/Enterprise product

- Should’ve managed a software development team

- Strong proficiency in software design principles, patterns, and architectural best practices

- Expertise in multiple programming languages and frameworks including Node.js, React.js, Express, PostGreSQL

- Experience in integrating with APIs, SaaS solutions, ETL platforms

- Experience with AWS

- In-depth knowledge of database design, cloud computing, and microservices architecture

- Excellent problem-solving and analytical skills

Key Attributes

- Strategic thinking and vision

- Strong leadership and communication skills

- Adaptability and willingness to learn new technologies

- Detail-oriented and committed to delivering high-quality solutions

- Ability to collaborate effectively in a team environment

Key Responsibilities

- Architectural Design & SDLC:

- Review existing architecture and oversee areas of improvement

- Lead the design and development of new features and enhancements

- Define and document high-level architecture, including system components, modules, and interactions

- Lead the entire SDLC lifecycle and be hands on as the lead for the development team

- Technical Leadership:

- Provide technical leadership and guidance to the development teams

- Mentor and coach team members, fostering a culture of innovation and excellence

- System Integration:

- Collaborate with stakeholders, including the product manager, engineers, and internal teams, to ensure seamless integration of software components

- Design and implement interfaces and integration points between various system modules

- Scalability and Performance:

- Design scalable and high-performance software solutions that meet current and future business needs

- Conduct performance analysis and optimization to enhance system efficiency

- Technology Selection:

- Stay current with industry trends and emerging technologies

- Evaluate and recommend technologies, tools, and frameworks that align with business objectives

- Ability to substantiate and take build-vs-buy decisions

- Security and Compliance:

- Integrate security best practices into the software architecture

- Ensure compliance with relevant industry standards and regulations

- Code Review and Quality Assurance:

- Conduct code reviews to ensure adherence to architectural guidelines and best practices

- Assist QA team members to establish and maintain quality standards

- Documentation:

- Document architectural decisions, designs, and guidelines

- Prepare technical documentation for both internal and external audiences

- Feedback & Enhancement:

- Analyses market & user research to make data-driven decisions ▪ Implement feedback from clients

Role Summary:

As an IT Engineer, you will play a pivotal role in providing technical support to our internal members and ensuring the smooth operation of our IT environment. You will work under the guidance of IT Manager to resolve technical issues, help end-users, and contribute to the overall success of our IT support team

Mandatory Skill Sets/Expertise

- 1-2 years’ experience in IT Support or a related role

- Strong knowledge of Windows and/or Mac operating systems

- Proficiency in troubleshooting hardware and software issues

- Familiarity with network configurations and protocols

- Certifications such as CompTIA A+ or Microsoft Certified Desktop Support Technician (MCDST) is a plus

- Willingness to learn and adapt to new technologies and methodologies

- Strong problem-solving and analytical skills Key Attributes

- Good communication and customer service skills

- Adaptability and willingness to learn new technologies

- Detail-oriented and committed to delivering high-quality solutions

- Ability to collaborate effectively in a team environment

Key Responsibilities

- Provide first-level technical support to end-users, both remotely and on-site

- Assist with the installation, configuration, and maintenance of hardware and software

- Troubleshoot and resolve hardware/software issues in a timely manner

- Monitor and respond to IT service requests and incidents

- Maintain accurate and up-to-date records of Assets, support requests, incidents, and resolutions

- Assist with user account management and access control

- Ensure IT security and compliance measures are adhered to

- Participate in IT projects, such as system upgrades and deployments

- Assist in creating and updating IT documentation and knowledge base articles

- Stay up to date with the latest technology trends and best practice

Role Summary

As a developer, you will be responsible for designing, coding, testing, modifying and implementing new features in the B2B SaaS product. You would closely work with the technical architect towards building a scalable GRC tool.

Mandatory Skill Sets/Expertise

- Proven experience as a developer, with a track record of building scalable B2B SaaS/Enterprise product

- Strong coding skills in Node.js, React.js, Express, PostGreSQL

- Expertise in multiple programming languages and frameworks including

- Experience in integrating with APIs, SaaS solutions, ETL platforms

- Experience with AWS

- In-depth knowledge of database design, cloud computing, and microservices architecture

- Excellent problem-solving and analytical skills

Key Attributes

- Excellent coding skills

- Good communication skills

- Strong analytical and problem-solving skills

- Adaptability and willingness to learn new technologies

- Detail-oriented and committed to delivering high-quality solutions

- Ability to collaborate effectively in a team environment

Key Responsibilities

- Experience in developing B2B SaaS /Enterprise products using Node Js and React Js

- Manage code deployments, fixe, updates and other related processes

- Produce scalable code as per product and business requirement

- Troubleshooting, debugging, maintaining and improving the existing product

- Responsible for developing technical documentation to guide future product development

- Conduct performance analysis and optimization to enhance system efficiency

Role Summary

As a Content Strategist & Editor, you would be responsible for strategizing and creating high quality, engaging and informative content including blog spots, articles, product/service descriptions and other forms of digital and print media. You would be responsible for enhancing the brand awareness of Accorian whereby contributing towards lead generation from prospective customers.

Mandatory Skill Sets/Expertise

- Master of spelling, grammar, and punctuation

- Holds a keen interest in reading and has a high level of comprehension

- Thorough grasp of the English language with advanced vocabulary and grammar

- Ability to summarize information without losing the original meaning

- Understand trending technological and business concepts correctly, write compelling copy for popular concepts

- Proficiency with software/applications such as Microsoft Word, Excel, PowerPoint

- Experience working in a start-up environment

- Ability to actively participate in the adoption of digital tools and strategies

- Preferred experience – creation of knowledge library

- Ability to bring in language and content standardization in presentations, documentation, and reports.

- Ability to work on multiple projects with different objectives simultaneously Key Attributes

- Excellent communication skills (written as well as verbal)

- Excellent attention to detail

- Business acumen

Key Responsibilities

- Conduct extensive research and interviews to ensure content is accurate and up-to-date

- Engage readers with an informative, entertaining, and educational copy

- Understand and consistently reflect the branding of the company

- Work closely with internal stakeholders and external subject matter experts to develop content

- Proofread to standardize existing documents and edit at various stages of the writing process in response to feedback from internal management

- Conduct spot checks to evaluate quality of work

- Resolve queries, especially those related to language and style

- Should be able to give eye-catchy headlines and provide keywords on a regular basis

- Coordinating and contributing to proposal production while working collaboratively with other team members

- Work on presentations by evaluating texts and graphics

- Performing plagiarism checks

- Review of text/content going on various social media platforms of Accorian

Drop your CVs to joinourteam@accorian.com

Interested Position