Article

Adobe's Common Controls Framework of Industry-acclaimed security standards

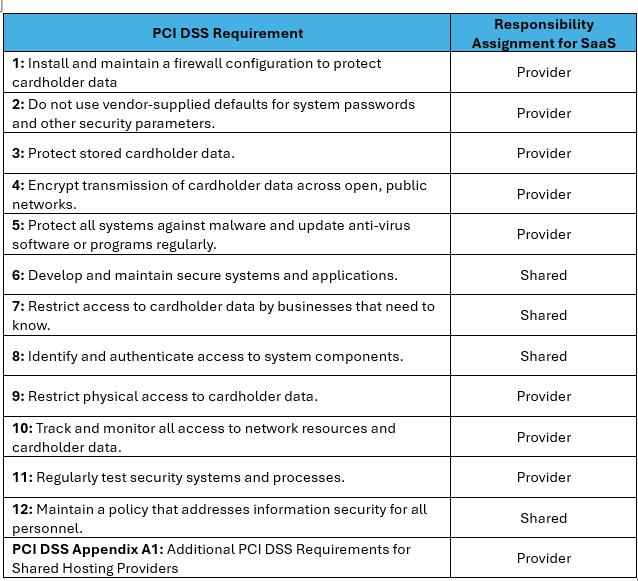

Today’s world is an ever-changing scenario with changes to the technology sector happening more frequently than ever due to emerging technologies. The case is quite similar in the field of Cyber Security. There are a few industry-acclaimed cybersecurity standards for governing the processes and execution of these standards. These standards are usually built upon a framework of control objectives that need to be implemented by the organizations to comply with these standards. Compliance is measured in terms of control objectives meeting the compliance criteria and also other regulatory and statutory criteria. Since most of these Cybersecurity standards speak of similar control objectives or lay emphasis on similar control areas, it is advisable to have the ‘Adobe’s Common Control Framework’, which means that if we are able to comply with a single requirement from a particular framework, in theory, we should be able to use the adherence of that requirement for ALL the similar frameworks. There are several approaches to achieving this Adobe's Common Controls Framework both in theory and in practice and will be discussed in detail later on in this article. The most relevant security and privacy frameworks are ISO 27001, NIST, PCIDSS, GDPR, SOC Type 2. There is a significant overlap of controls contained in these standards as all of these standards primarily deal with one requirement which is the protection of data. Protection of information from unauthorized disclosure, compromise, and theft forms the backbone or the building blocks of an Adobe's Common Control Framework. This leverages the fact that similar controls or that the essence of the controls is the same across standards and can be used to gauge the adherence or compliance of an organization to the standard. In actual execution, while gauging the compliance of an organization, the Adobe's Common Controls Framework is not only holistic but can reduce the effort and cost otherwise required by the organization to comply with individual standards. There are two methods of developing the Adobe's Common Control Framework for an organization and there are very subtle differences between the two methods. They are Controls harmonization and Controls Mapping. Controls Harmonization: Harmonization is the creation of a brand-new control language set from several source languages of standards taking into consideration content & context. In theory, the intent and meaning of the words and sentences remain intact, but the language and actual words of the individual standards have been changed with a new harmonized meaning defined. To achieve the usage of a single language as an industry, globally, it would have significant benefits and it would be the most efficient way to operate not only as security professionals but also as humans. Adobe’s Common Control Framework is an example of this type of construct. The benefits of having a single operating language can truly be amazing in terms of effort reduction and cost reduction. Control Mapping: Today, most brilliant and forward-thinking security professionals are using the control mapping method. The main idea behind this method is to keep the original language intact as much as possible while mapping and matching the intent and meaning of each sentence and word. This is the most practical and realistic approach because this is how humans fundamentally interact with each other globally. One can see this working in real life where two different languages are being spoken by individuals and kept mainly intact, but an interpreter or linguist is translating between the two — the map is developed in the mind of the linguist. Some real-life examples of mapping for cybersecurity frameworks can be seen in HITRUST Framework, Cloud Security Alliance Framework, and even the U.S. Government formally...

View More